M&A is accelerating again in 2026. But the competitive edge has shifted: the winners aren’t just better at sourcing deals - they’re better at M&A due diligence and execution.

We’re entering an environment where transformative “dream deals” are increasingly driven by strategic repositioning and AI-led reinvention, while scrutiny and complexity keep rising. (Goldman Sachs) That’s creating a paradox: more opportunity, more ways to lose value after signing.

This post breaks down the key M&A trends shaping 2026, why M&A due diligence is harder than ever, where value leaks, and what a modern execution-ready diligence operating model looks like-powered by AI in M&A and M&A workflow automation.

Executive Summary

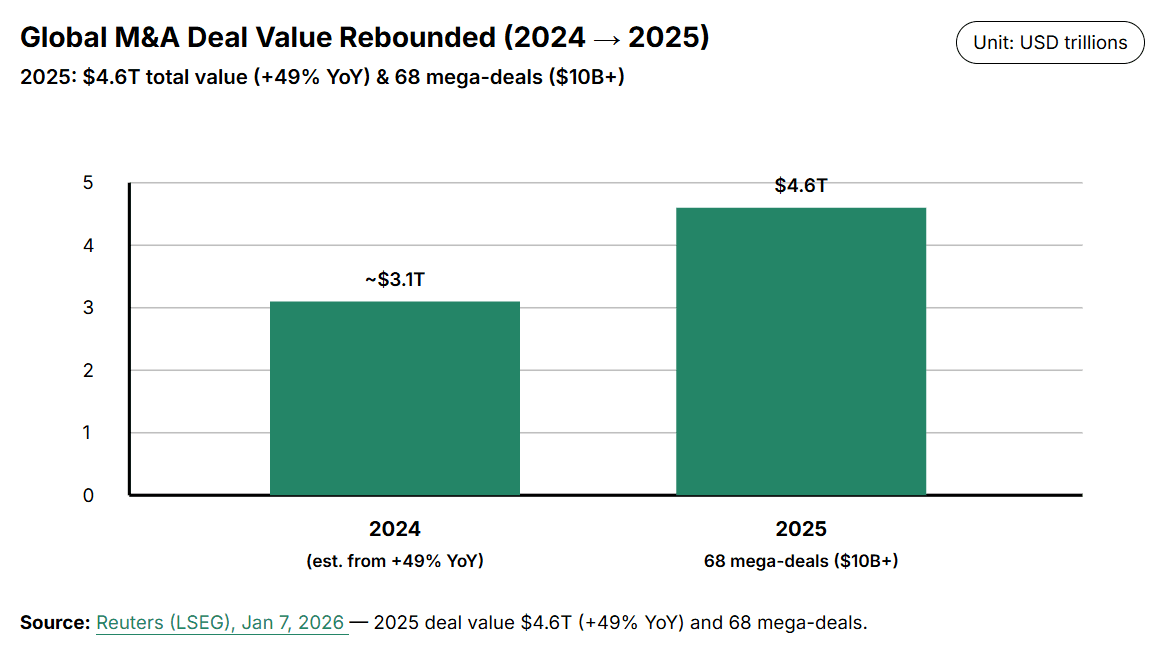

Deal momentum is strong. 2025 ended as an exceptionally active year with near-record global M&A value and a record count of $10B+ megadeals, setting up a “bulging pipeline” for 2026. (Reuters)

But execution risk is now the main ROI variable. Longer review cycles, tougher negotiations on regulatory risk allocation, and higher integration complexity are reshaping how deals are won and completed. (Passle)

M&A due diligence has expanded. Beyond financial and legal diligence, deal teams increasingly need credible reads on cyber risk, IT architecture, ESG exposure, and data governance-and the ability to synthesize it fast. (EY)

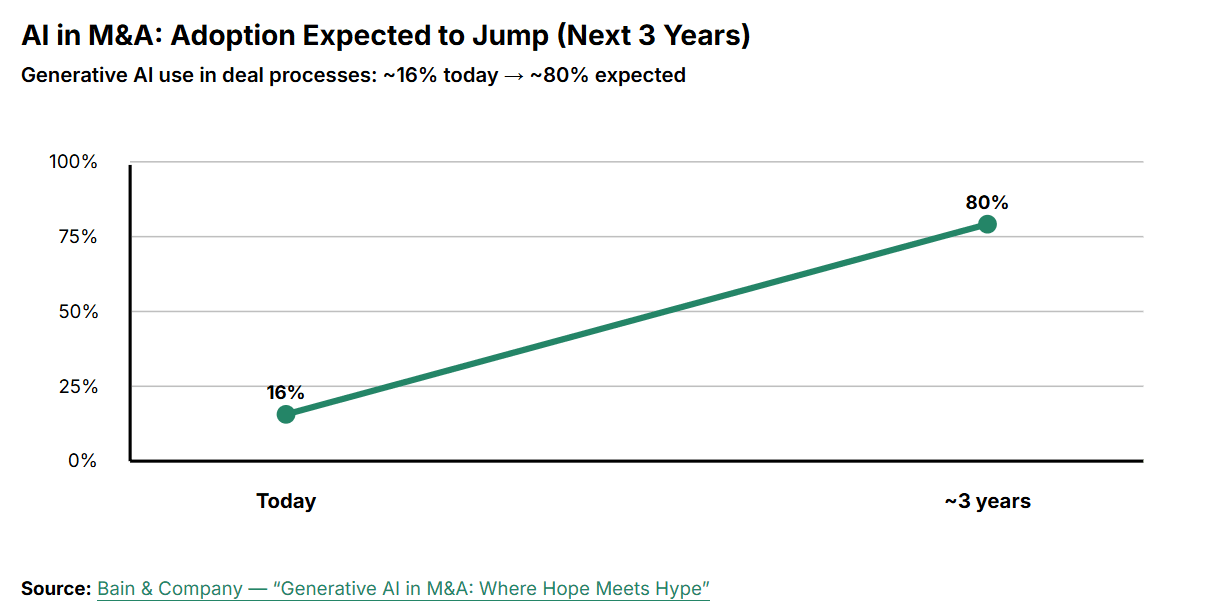

AI in M&A is moving from optional to expected. Bain reports generative AI use in deal processes is ~16% today but is expected to reach ~80% over the next three years. (Bain)

Bottom line: In 2026, the strongest deal teams win by building execution-ready commercial due diligence and an operating model that reduces delay, rework, and integration drift.

1) State of M&A Entering 2026: More Deals, Higher Stakes

The top-line signal is clear: deal value rebounded sharply, and mega-deals returned in force.

- Reuters (LSEG data) reports 2025 global deal value ~ $4.6T (+49% YoY) and a record 68 megadeals ($10B+), a level of “big deal” activity that typically raises complexity across diligence, regulatory approvals, and integration. (Reuters)

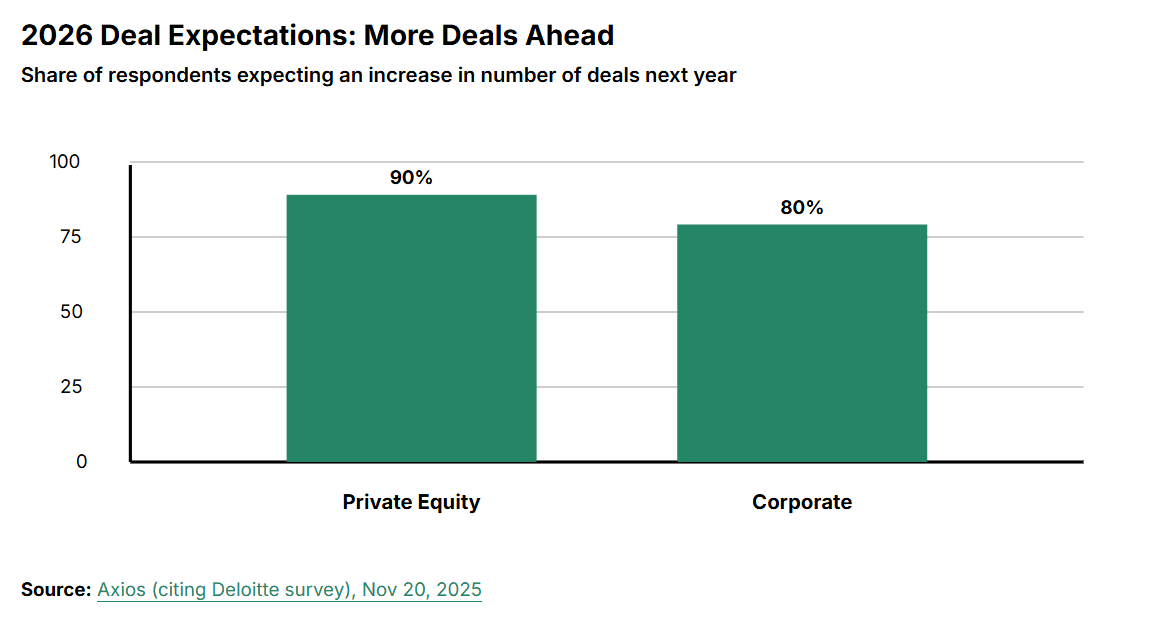

- Deal sentiment heading into 2026 remains upbeat. Deloitte’s 2026 M&A Trends Survey indicates large majorities of corporate and PE dealmakers expect increases in both the number and value of deals over the next 12 months. (Deloitte)

- On the U.S. side, a Wachtell memo summarized on the Harvard Forum suggests U.S. M&A deal volume was on pace for ~$2.3T (up 49% from 2024) with a return of very large deals. (Harvard Law Corporate Governance Forum)

Meanwhile, the strategic narrative behind this cycle is not “cheap money and scale” alone. Goldman Sachs frames 2026 as an “innovation supercycle” era where leaders pursue “dream deals” to acquire capabilities-especially in AI-adjacent domains. (Goldman Sachs)

2) Why M&A Due Diligence Is Still Hard in 2026

Regulatory friction turns signing-to-close into an endurance test

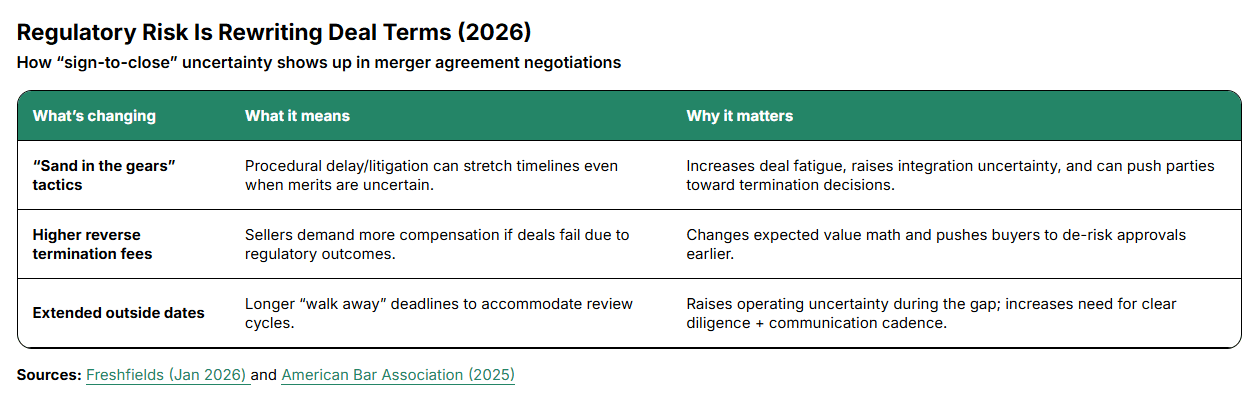

Freshfields points to the procedural tactics (“sand in the gears”) used by enforcers in recent years to delay and litigate deals, even when outcomes were uncertain-making timelines and certainty harder to underwrite. (Passle)

Deal terms are adapting accordingly: Lexology expects greater intensity in negotiating regulatory risk allocations, including pressure for higher reverse termination fees and extended outside dates. (Lexology)

Diligence scope has widened (and synthesis is the bottleneck)

2026 diligence increasingly demands a coherent answer to:

- What’s the commercial reality? (market structure, demand stability, competitive dynamics) → commercial due diligence

- What’s the technology reality? (architecture, data flows, integration constraints)

- What’s the cyber and data exposure? (breach risk, control gaps during transition) (EY)

- What’s the ESG exposure? (portfolio expectations, diligence and reporting needs) (EY)

This is why “more diligence” often means “more chaos” unless teams invest in structure and workflow.

3) Where Value Leaks: It’s Not Just Price - It’s Process

In 2026, value destruction often happens in four predictable places:

Delay kills momentum (and sometimes the deal)

Long review cycles and complex approvals can drain organizational energy and create “deal fatigue,” especially when public narratives or stakeholder concerns shift midstream. (This is also why regulatory risk allocation has become a front-and-center negotiation topic.) (Passle)

Commercial ambiguity forces rework late in the process

If commercial due diligence doesn’t produce a decision-grade view, teams end up revisiting basics (market size logic, customer drivers, competitor behavior) late in the cycle-exactly when timelines are tightest.

Tech/cyber surprises multiply post-close integration risk

Cybersecurity risk doesn’t pause during M&A-transition periods can create exposure as access controls, systems, and vendors change. EY emphasizes the importance of identifying vulnerabilities and quantifying cyber risk through the deal lifecycle. (EY)

Post-close drift (the first 100 days decide outcomes)

Teams can have a strong thesis and still lose value if the combined organization lacks clear sequencing, accountability, and KPI discipline after close-especially when integration spans functions, systems, and cultures.

4) The 2026 Operating Model: Execution-Ready M&A Due Diligence

Winning teams are updating their operating model in four practical ways:

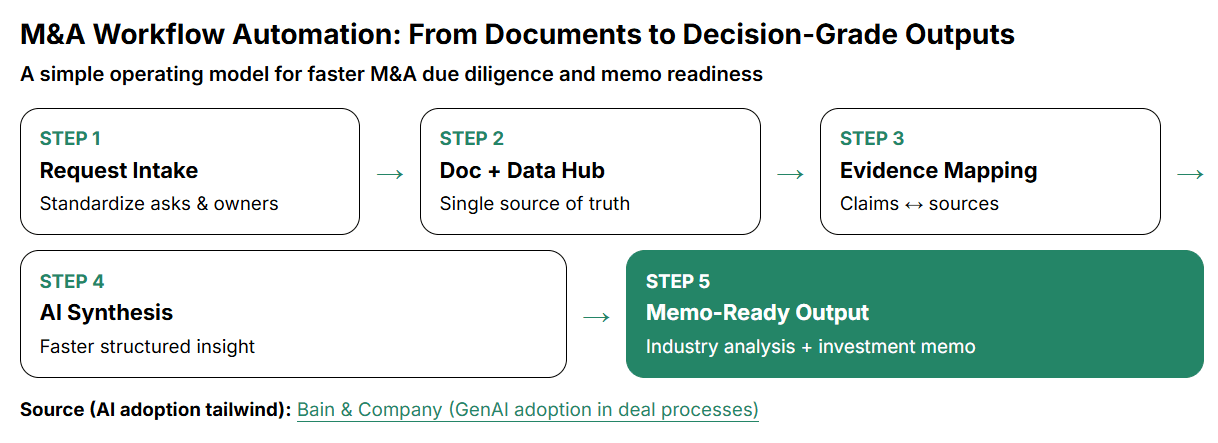

They treat diligence as a throughput problem (and automate the machine-work)

This is where M&A workflow automation shows up: standardizing request lists, document intake, source management, versioning, and evidence mapping-so humans spend time on judgment and decisions rather than admin.

They deploy AI in M&A, without outsourcing accountability

Bain reports genAI use in deal processes is low today (~16%) but is expected to reach ~80% over the next three years; early adopters already see benefits, while the real challenge is building differentiated advantage (not just experimenting). (Bain)

In practice, “good AI” in diligence is:

- fast synthesis + structured output

- evidence traceability

- clear human sign-off on key assumptions

They run commercial due diligence like a product (consistent, repeatable outputs)

Rather than “research decks,” the output standard is:

- a defensible industry POV

- competitor dynamics that explain who wins/why

- risk flags linked to thesis assumptions

- a memo narrative leadership can act on

They widen diligence scope intentionally (cyber + ESG + data governance)

Instead of bolting on extra diligence at the end, they scope it upfront and keep it connected to deal value and integration feasibility. (EY)

5) Problem → What Binocs Offers → Outcome

Below is the execution stack that matters most in 2026-and how Binocs is positioned to help.

| 2026 Diligence / Execution Problem | What Binocs Offers | Outcome |

|---|---|---|

| Unstructured M&A due diligence (docs everywhere, no single source of truth) | Centralized deal workspace + structured diligence workflows | Faster cycles, fewer blind spots, less rework |

| Commercial due diligence bottleneck (too many sources, slow synthesis) | Agentic AI to accelerate research → decision-grade industry analysis and investment memo outputs | Clear POV faster; tighter decision narrative |

| Expanded diligence scope (cyber/ESG/tech questions stall teams) | AI-led services + structured synthesis where bandwidth is limited | Coverage improves without derailing timelines |

| Post-close execution drift | Growth strategy support to translate thesis into prioritized initiatives + execution cadence | Better Day 1 readiness and value capture |

6) Implementation Checklist

For Corporate Development Teams:

- Define your “execution-ready” M&A due diligence standard (what every deal must answer)

- Upgrade commercial due diligence outputs: industry POV → competitors → customers → risks → thesis logic

- Add cyber and data governance diligence early (not as a late add-on) (EY)

- Scope ESG diligence in a way that maps to value and integration feasibility (EY)

- Use AI in M&A to automate the throughput layer (synthesis, structuring, evidence mapping) while keeping human accountability (Bain)

For M&A Consulting Partners:

- Treat “the narrative” as execution infrastructure (not slidework)

- Package commercial due diligence so it’s defensible: assumptions → evidence → implications

- Build a repeatable workflow that reduces rework loops (this is where automation creates leverage)

- Use AI in M&A for speed, but differentiate with judgment, scenario logic, and integration feasibility (Bain)

Conclusion

M&A is back in 2026. But the differentiator is no longer deal access alone, it’s whether your team can run execution-ready M&A due diligence that keeps pace with scrutiny, expanded risk scope, and integration complexity. (Reuters)

If you’re looking to accelerate commercial due diligence (industry analysis + investment memo outputs) and build a repeatable operating model for 2026, Binocs can help.

Schedule a demo to see how Binocs supports faster, more consistent M&A due diligence and execution.